During the 6th season of mark months, your firstborn’s expenses arrives, so that you borrow $7,000 from the mortgage, leaving you which have $13,000 in the credit line

Their top investment as a citizen is the dependent-inside the security of your property which are leveraged because the an excellent proverbial gold-mine. Property security credit line, or HELOC financing, is a famous mortgage getting consumers selecting freedom more a keen longer period of time to fund any sort of lives events can come the method – at home renovations to school university fees so you’re able to starting a business, plus. Find out about the benefits and you can drawbacks regarding a beneficial HELOC loan and how you might determine monthly payments that will allow that comfortably pay-off your responsibility.

A good HELOC financing is a type of second mortgage which allows you to safer reasonable-pricing finance with your home’s centered-within the collateral. There’s two amount in order to a great HELOC financing: the fresh mark period plus the payment several months. In the draw period, you should use cyclically borrow secured on and you can repay the financing amount available to you. It’s titled attracting, because you mark throughout the loan during the it an element of the name. Once the draw period finishes, you will enter the cost period whereupon the latest HELOC financing need end up being paid down in full.

For example, what if you have got $20,000 you should use pull out alternative medical student loan from the house’s collateral on the a thirty-season HELOC financing name having a proportion away from 10 years so you can mark and you will 20 years to settle the loan. When you look at the first 12 months of your HELOC mortgage, you opt to use $ten,000 to complete property recovery venture (so that you now have $ten,000 online out of your credit line). You earn an-end-of-the-seasons extra and determine to pay back $8,000 on which you have taken away, so you possess $18,000 property value funds out there on your own HELOC financing. With this initial several months, you can make use of borrow against and you may pay-off their distinctive line of borrowing. Because the ten-seasons borrowing from the bank period finishes, youre compelled to pay the a great number on your credit line (which in this example is actually $seven,000).

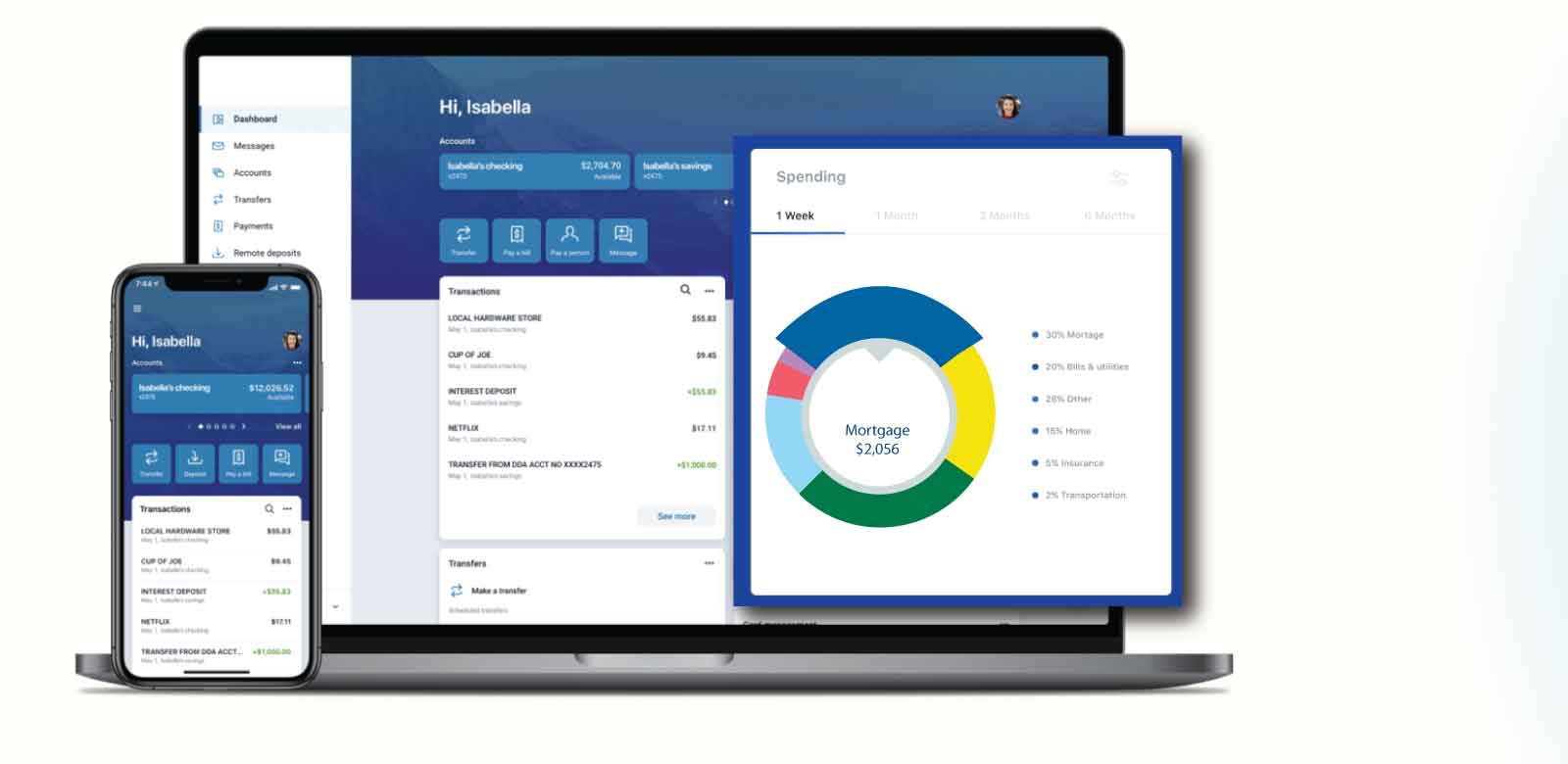

A HELOC Rewards Calculator is a helpful device from inside the choosing how far you should set towards your monthly installments to repay their HELOC mortgage.

- Current Equilibrium. This is actually the most recent an excellent equilibrium on your own personal line of credit.

- Interest. This is basically the yearly interest rate in for your own collection of borrowing from the bank.

- Change in Interest. Like a supply loan, a good HELOC’s interest varies within the alignment that have industry trends. For it enter in, fill out simply how much you expect the eye to switch inside the second seasons. If you expect the attention to reduce, enter in negative quantity.

- Incentives Purpose. This is the title the place you hope to get HELOC loan repaid. Go into the level of months in which you wish to features your loan paid off for this input.

- Newest Payment per month. Here is the amount you currently contribute every month to the investing out of their HELOC financing. Definitely go into the matter you actually shell out per month (perhaps not minimal commission). It figure can be used to decide how much time it will require you to pay-off the balance on your line of credit.

- Additional Monthly Costs. It input is actually for the entire in the the newest charge you want to wear their line of credit monthly.

- Annual commission. This really worth stands for the brand new yearly fee you have to pay getting your own credit line discover.

Whenever you are HELOC money are a good financial financial support that can offer your flexibility, it is very important look out for their variable interest levels. Consequently the pace movements during the alignment on market, and you will typically resets a-year otherwise semi-a year. While searching for a comparable re-finance arrangement with a fixed rate of interest, you should check aside a property security mortgage, that provides your that lump-sum number that should be reduced across the life of the new financing. A funds-aside refinance may also ideal match your monetary need just like the an excellent homeowner.

A HELOC financing uses your property as the collateral, thus be sure to have the monetary power to repay your own mortgage or you might end up being prone to property foreclosure for people who standard on your own financing. Furthermore, the financial institution have a tendency to pre-dictate a borrowing limit for your mortgage. New restrict approved on your own personal line of credit depends abreast of an analysis of your own property’s appraised value minus the balance due on your mortgage. The verifiable earnings, expense, and you may credit rating can certainly be factored on starting your credit limitation approval.

Once you have computed this type of inputs, you can begin which will make a financial course of action one to keeps your on course to repay their HELOC mortgage because of a lot more under control monthly premiums

Your house Financing Professional took its large crack by the permitting property owners from inside the neighboring teams become aware of refinancing potential accessible to them who would place them during the a much better reputation economically. Since then, we are in a position to expand the characteristics all over the country to find people as you a knowledgeable contract you can easily towards the a loan. Our very own friendly credit pros are from the same organizations it serve, therefore we is acquainted with the buyer’s demands.

We shall aid you to bring about an economic plan of action that specifically serves your specific finances and you may homeownership requires. I work easily to help make the application for the loan processes as the painless that you can, with an efficient underwriting process that can get you approved toward financing within 2 weeks. A great HELOC rewards calculator is a wonderful device whenever opening brand new research procedure for simple tips to pay back their personal line of credit owing to possible monthly installments. We understand that you might have questions or questions that are beyond your container. Therefore give us a call today at 800-991-6494 to talk to one of the amicable and you may experienced financing Advantages. Or, you can get in touch with united states courtesy the software to acquire aside how you can dictate affordable monthly premiums on your own HELOC financing.