Addition to help you choices to help you an opposing financial

The elderly has actually a number of an effective selection so you can a contrary home loan, labeled as a house collateral sales home loan (HECM). That does not mean that HECMs are always bad; it’s just they are never the best solution for a good senior homeowner trying to more funds disperse.

Officially, a keen HECM ‘s the style of opposite mortgage that’s partly guaranteed from the bodies. You could potentially nonetheless rating completely private-markets reverse mortgage loans. However is capture significantly more care and attention contained in this less-regulated career. Swindle writers and singers and other predators lurk here.

In this post, we will end up being exploring the advantages and disadvantages off contrary mortgages and you may enjoying the way they pile up up against other ways from elevating financing if you are an elder.

What is an opposing home loan as well as how can it work?

Before we view choice in order to an opposite home loan, we would like to investigate real thing. Very, why does a reverse financial work?

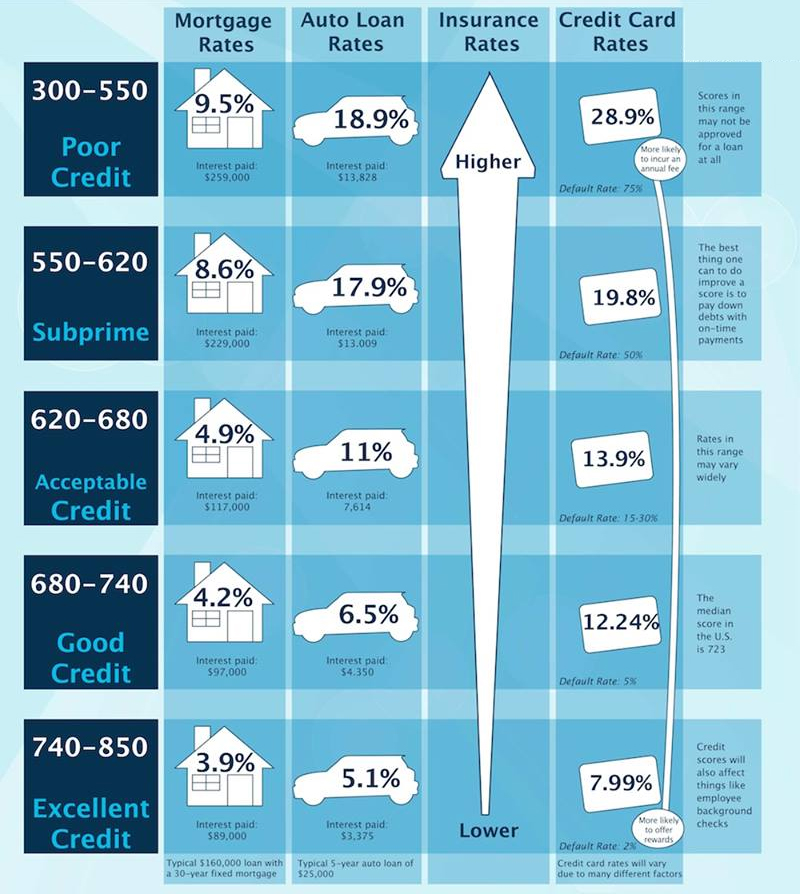

Really, to obtain you must be at the very least 62 yrs old, own your own home, while having the lowest or zero mortgage equilibrium. The lender try unrealistic as most finding the credit get, money or current debt burden since you will never be and work out people monthly obligations towards the mortgage.

Wha-a-at? Zero monthly premiums? Nope, none after all. You can view as to the reasons reverse mortgages was basically so popular after they first emerged.

A diminishing asset

Although no-costs issue is a two fold-edged blade, that’s the reason contrary mortgages was less common today. As, per month, the bill on your own financial presses up of the count the commission would have been, as well as cumulative desire. And you may, when the time comes to pay, this type of contrary mortgage loans is capable of turning out over was very costly indeed.

That point once you must pay arrives when you vacate the domestic. Perhaps you get a hold of you’d desire reside in a pension studio, care and attention household otherwise together with your adult college students and other relatives. You ount you can remain when you offer your home. Or perhaps your pass away while you are still-living of your house. Their problems are more than your kids may not get the genetics these people were hoping for.

An effective lifeline for many

You can observe that some people are nevertheless keen on opposite mortgage loans. Such as, people with poor credit, lower old-age revenue, or a leading established debt obligations, could find it difficult to get acknowledged for other brand of borrowing, like a consumer loan. And those no (or estranged) offspring might not proper care that their display of the value of their home is diminishing timely.

Other loans in Killen people, yet not, ine alternatives in order to a reverse mortgage. And we’ll will men and women soon. However,, first, why don’t we set out advantages and you may downsides.

Benefits and drawbacks off an opposite financial

Reverse mortgages, and that permit property owners to make a fraction of their house equity on funds, establish individuals pros and cons. Here are a few:

- No monthly home loan repayments – Nothing, thus no later fees, often

- Make use of the proceeds for purpose – Pay money for from inside the-home care; consolidate your financial situation; improve your money because of assets otherwise an annuity; improve your family otherwise adjust they for the unique requires; ideal your offers;

- Relatively easy to find – Your opposite home loan company does approve your application if you may have a solid credit rating, earnings, and absolutely nothing-to-no established costs

- Contrary mortgages are pricey over the years – They often have large settlement costs and you will rates of interest than conventional mortgage loans or other family equity issues

- Those higher costs is also whittle away your own express of your worthy of in your home, leaving you or their heirs that have below questioned once you move out of the property