Conceptual

Despite the rates regarding owning a home around australia drifting down more latest watched a big rise in basic family requests. Considering the advanced level away from casing pricing and you may household indebtedness, this enhances the matter of if or not very first home consumer (FHB) money lead disproportionately so you’re able to economic stability and you may macroeconomic threats. He has high financing-to-valuation percentages and lower exchangeability buffers. While this you will suggest FHBs is more susceptible than other individuals while in the a terrible income or construction rate surprise, current sense reveals that FHBs was indeed no more gonna statement financial be concerned or perhaps be when you look at the arrears. One to possible cause would be the fact FHBs possess typically knowledgeable most readily useful labour industry effects than other individuals.

Inclusion

More the past several years, there’s been a set-up-up of general risks associated with rising and you will higher quantities of home indebtedness. This type of threats normally jeopardize the stability of the financial system given that better just like the macroeconomic balance because of the possibility of very in financial trouble homes in order to enhance monetary unexpected situations (RBA 2021). When examining these threats, government monitor and you may evaluate manner round the various types of lending. This information focuses primarily on whether or not credit so you can basic homebuyers (FHBs) adds disproportionately in order to total systemic threats.

Casing mortgage commitments to help you FHBs increased dramatically over 2020, supported by government apps geared towards improving owning a home instance the original Home loan Put Plan, plus low interest rates (Graph 1). More 2021, the worth of FHB responsibilities denied a small just like the rapid gains in the housing costs managed to get more complicated getting FHBs to get in the market. With the escalation in trader passion, this noticed FHBs’ show out-of duties will not simply over 20 % of your worth of total houses financing requirements in 2021.

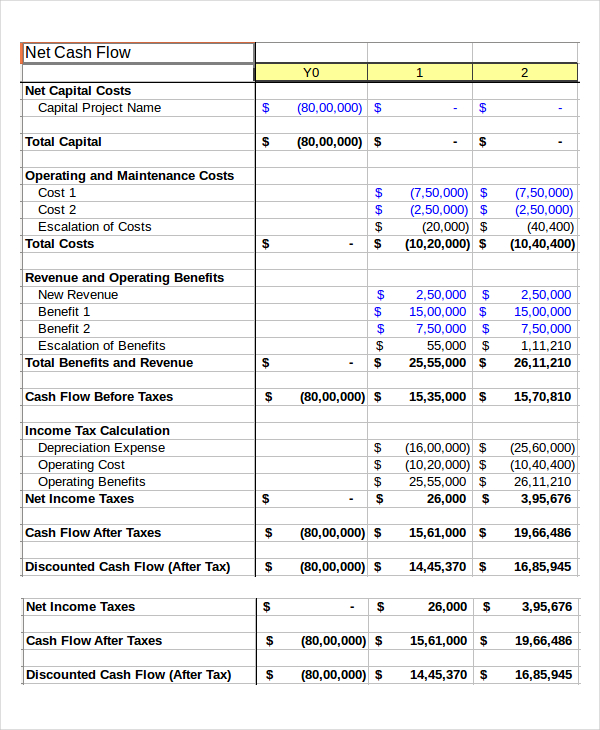

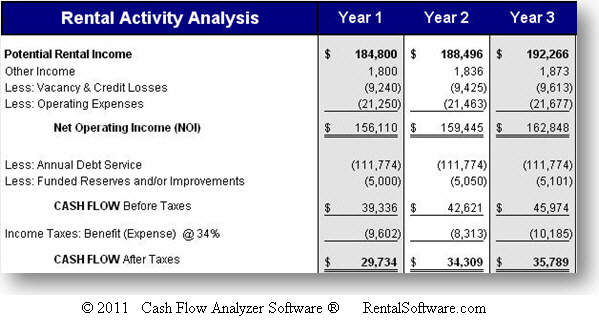

To evaluate the fresh riskiness of FHB fund in line with other finance, I put a broad list of metrics from the more level from the mortgage existence. These types of metrics https://availableloan.net/loans/checking-account-with-bad-credit/ advised if FHBs can be more at risk of defaulting on their financing or draw right back to their consumption during the a monetary amaze than other individuals. FHBs typically obtain a much higher show of value of the property than other manager-occupiers or buyers, since the racking up a deposit is often the head burden so you’re able to typing the fresh new housing marketplace. FHBs as well as tend to have all the way down buffers away from liquid assets you to definitely can help secure the use during the a terrible income or expenses shock in the 1st few years of one’s financing. not, FHBs also are generally on an early phase of the industry, and therefore has actually usually knowledgeable more powerful money increases and now have already been not any longer going to sense earnings losses than other borrowers.

Loads of study provide were utilized to assess the fresh relative riskiness out of FHBs. To own fast information on the features of new FHB finance, I used monthly investigation gathered of the Australian Prudential Control Power (APRA) into the good greatest endeavours basis’ towards the biggest mortgage brokers and you will mortgage-level analysis on Reserve Bank’s Securitisation Program. The Securitisation System contains detailed data on every of your own mortgages hidden Australian residential mortgage-supported bonds, symbolizing around you to definitely-third off Australian mortgage loans. Household-top questionnaire analysis regarding the ABS’ Questionnaire of cash and you may Homes (SIH) and also the Domestic, Income and you will Labor Personality around australia (HILDA) Questionnaire provided a greater listing of FHB debtor characteristics, as well as financial be concerned knowledge and you can work industry outcomes.

Features away from FHBs

FHBs are typically more youthful than many other brand new proprietor-occupiers and you will buyers, as the average chronilogical age of FHBs might have been gradually expanding more go out (Desk step one). For the , new average chronilogical age of FHBs (with funds around 36 months old) was 33, which was doing 10 years young versus median period of almost every other consumers having money as much as three-years old. Which decades gap could have been apparently persistent over the past couples off many years. The latest rising age of FHBs could have been determined because of the high homes rates enhancing the go out necessary to conserve getting in initial deposit, along with group activities eg ily taking place after inside lifestyle (Simon and you can Stone 2017). The average date needed to save your self having a deposit for the a great median-listed hold all over Australian funding urban centers have went on to go up to become almost 7 many years inside the 2021.